Leveraged Savings Enquiry

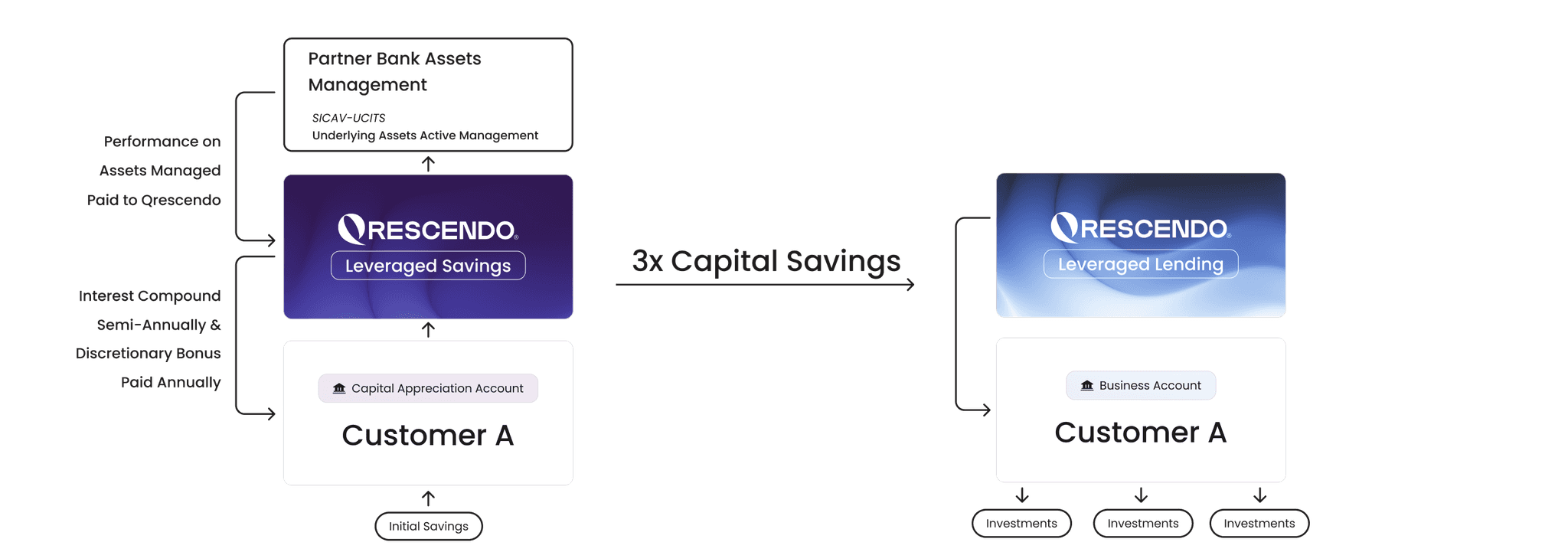

Qrescendo offers a streamlined investment and leveraged lending solution that integrates a 60-month leverage savings account with the potential for performance bonuses from actively managed funds, alongside access to leveraged financing.

About

Benefits of Qrescendo’s Investment & Leveraged Lending Ecosystem:

Fixed Income Returns from Savings Account

Discretionary Bonuses from underlying SICAV-UCITS Funds

Access to Highly Competitive Interest Rates for Leveraged Lending Platform (x3 Capital Savings)

Step 1

Placement of funds to enter our competitive

leveraged savings market.

Summary terms:

60 Month Term

Targeted Fixed Interest rate of 6%

Interest Compounded Semi-Annually, Paid at Maturity

Discretionary Bonus paid annually based on the performance of underlying SICAV & Funds

Investment Objective: Generate recurring capitalised income and long term capital appreciation

Step 2

Access Qrescendo’s Leveraged Lending Platform.

Summary Terms:

Access Leverage Lending X 3 of Capital Placement

Competitive Interest Rate

Market Standard Due Diligence & Credit Risk Assessment

Credit insurance before facilitating investors exit

Investment Objective: Facilitate Investor Exit and Return of Investment

Key Advantages

Qrescendo goes beyond traditional banking to offer comprehensive

corporate solutions, empowering businesses to store, manage,

and move their funds efficiently.

Customer Eligibility

Available for individual Angel Q-Investor, SMEs, Startups, Scaleups

Family Offices, Venture Capital, PE Funds, Endowments

Institutional accounts allowed for higher minimum placement of funds

Documentation required: Valid ID, proof of address, and income statements for larger placement of funds

Advantages

Planned returns of 6%

Discretionary Bonus paid annually based on the performance of underlying SICAV & Funds

Availability to increase Investment Power through our Leveraged Lending platform

Ideal for conservative Entrepreneurs, Financiers, Investors seeking capital preservation and access to our Leveraged Lending platform

Dividend Rate

Fixed semi-annual rate of 6% for the duration of the term

Paid at maturity

Plus, a discretionary bonus, base of underlying SICAV-UCITS Outperformance, payable annually

Savings Amounts

Minimum Amount:

$ or €: 100,000

Maximum Deposit Amount: Open

One Time Fee of 0,50% on placement of funds

Features

No monthly account fees

Borrowing capacity x3 of base capital savings

About

About

About

Key Advantages

Key Advantages

Key Advantages

Leveraged Saving Enquiry Form

Qrescendo Inc is a Business and Investment

Neobank, operating in the USA, Europe and UK.

What is Financial Leverage?

What is Financial Leverage?

What is Financial Leverage?

What we aim to deliver

What we aim to deliver